The coming economic crisis, “unorthodox” monetary policy, and Donald Trump

By Mike Treen

September 7,2019 — Links International Journal of Socialist Renewal reposted from The Daily Blog NZ — What is behind the “unorthodox” monetary policies of the US and other Central Banks?

There is much discussion today around how effective monetary policies are in regulating the ups and downs of the business cycle.

Monetary policies are run by the Central Banks of the respective countries with the US Federal Reserve operating like the world’s central bank. Their principal tools are the setting of certain interest rates they can control or influence and creating or reducing the supply of token money.

The US Federal Reserve resumed monetary creation policies earlier than expected at its July 30/31 meeting including a cut in what is known as the federal funds rate from 2.5% to 2.25%. They also halted the repurchase of the massive amounts of token money issued between October 2008 and October 2015 in response to the global financial and economic crisis of that time.

To understand what is happening we need to understand the interaction of three types of money in existence today.

Gold

One form is gold which as a product of human labour has emerged as the universal equivalent of all other commodities as a measure of value. All societies with a developed system of commodity production and exchange need a universal equivalent to function. Gold can also be hoarded for its intrinsic value, especially in times of monetary disorder.

Gold does not disappear. It always retains its value through any crisis. Capitalists and central banks hold a portion of their wealth or reserves in gold because of these special properties.

Token Money

The second form of money is token money issued by the state, dubbed “fiat” money by economists.

So long as the currency is not “over-issued” relative to the existing quantity of gold the currency – whether it be dollars, pounds, yen, or rupees – can retain its value so long as it is backed up by a state power which can impose taxes and use force on those it wants to do its bidding.

But if the currencies are “over-issued” they lose value in proportion to the over issue. A doubling of token currency will in normal circumstances result in a halving of its individual value. In other words, the currency price of gold will double. This is the origin of general price inflation we saw during the 1970s and early 1980s. Then US President Richard Nixon declared “We are all Keynesians now” and believed he could finance the Vietnam War without massive cutbacks in social spending in the US through budget deficit spending. The end result was a steady devaluation of the US and other currencies and endemic inflation worldwide.

The first casualty of this policy was for the US dollar to cut its link to the gold at $35 an ounce in 1971. Being “free” of the gold “shackle” as it was dubbed by opponents of the gold standard, only encouraged further devaluation. The price of gold hit $120 an ounce in 1976. Soon we had “Stagflation” – inflation and economic stagnation at the same time. By the late 1970s, there was a flight out of the US dollar into gold that saw the “price” of gold soar to nearly $600 an ounce. To prevent a total collapse of the currency the US Federal Reserve had to refrain from further accelerating the rate of growth of the dollar it was creating which boosted interest rates to record levels of 20% for the Federal Funds Rate and drove the economy into a deep recession. Bad as inflation was – especially for real wages of the working class, which was being paid in debased currency – from the viewpoint of the capitalist economy the worst result was this rise in the rate of interest.

These policies were dubbed the “Volker Shock” after the then Federal Reserve chairman Paul Volker. As they took effect, inflation dropped from 14.8% in March 1980 to 3% by 1983. By the mid-1990s gold stabilised for a period at around $400 an ounce.

The amount of token money that can be issued is governed by the total amount of gold bullion in existence in the world. This usually expands at a relatively steady pace of say 2% a year so it is a relatively safe bet that token money can also be increased proportionately. But gold production also has its own cycle which runs counter to the normal industrial cycle and impacts interest rates and places objective limits on token money and credit creation.

If there were no objective limits to the creation of token and credit money there would never be a crisis of generalized overproduction every ten years or so like we have seen throughout the 150-year history of developed capitalism. These crises have been analysed and explained by Karl Marx as being generalised crises of overproduction relative to the ability of the market to absorb these commodities at prices that guarantee the producer at least the average rate of profit. Overproduction is reflected in growing inventories, factory shutdowns and unemployed workers. If token money or credit could be expanded at will forever then there could be no such crises. That is why pro-capitalist economic writers can’t explain why the crises happen.

Monetary authorities don’t really understand what exact total of token money they can issue without devaluation. They operate to a great degree on trial and error. They don’t know what they are measuring the currency against but the consequences of over-issuing become apparent very quickly in a rising price of gold, a broader leap in commodity prices in terms of the devalued currency and then a general rise in prices. This forces the central bank to increase interest rates, cut back on the currency being issued or purchasing previously issued currency to neutralise it. Failure to take action can lead in some extreme circumstances to hyperinflation and a currency collapse.

Credit money

The third form of money is credit money. Under a developed system of finance and credit this credit money is created and centralised by the banks through making loans. They are able to use deposits of token money created by the central bank as a base from which to expand lending many times over the amounts of customer deposits. So long as everyone doesn’t want their money back at the same time the merry-go-round can continue. This is called fractional reserve banking.

But banks are a profit-making competitive businesses. They have a built-in tendency to seek more and more creative ways to create and extend credit to maximise their returns. Derivatives that serve as a kind of insurance against loans going bad are the latest example of that. Eventually, as inventories of unsold commodities pile up and credit tightens a breakdown happens which will begin at the weakest links of the credit chain. A credit crisis and collapse of at least the most over-extended institutions then follows.

Credit money is not “real” money like gold and can disappear completely without a trace. In fact, the over-issuance of credit must be periodically neutralised for the system to restore balance. If there is no reduction in credit money then credit money is essentially being converted into token money. This will fuel an inflationary surge sooner rather than later with the inevitable consequences of a spike in interest rates leading to a deeper credit contraction, the very thing that conversion of credit money into token money is designed to avoid.

There is a real fear that exists in the global economy because the world is going into a new economic crisis and the monetary tools that are available to deal with the crisis are virtually non-existent compared to 2008.

Interest rates

Interest rates are close to zero unlike in 2008 when they could be cut dramatically. In the US they went from 5.25% to zero. In New Zealand, the Reserve Bank’s Official Cash Rate went from 8.25% to 2.5% in a year. It is now at 1%.

The US Fed and other central banks also indulged in the massive printing of token money, dubbed Quantitative Easing. That cannot be repeated in the same way for reasons I will discuss.

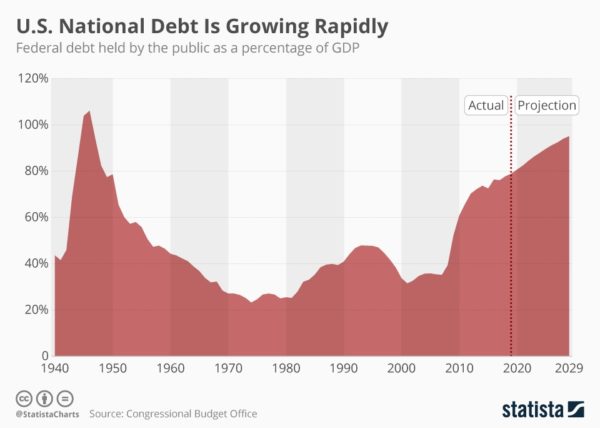

Most government also have limits to their ability to use fiscal measures to counter the approaching downturn through the government spending more than it takes in taxes. Most major capitalist governments massively increased debt after the 2008 crisis and a new round of deficit spending like that would likely lead to surging interest rates and economic collapses rather than a new stimulus. New Zealand is a little unique in advanced capitalist countries for the low level of public debt and that gives the New Zealand government somewhat more room to maneuver than would otherwise be the case.

Government deficit spending also pushes interest rates higher than they otherwise would be and undermines the rate of profit of enterprise as a consequence.

This happened to a degree with US President Trump’s tax cuts that were implemented in 2018. The resulting huge budget deficits helped push up long-term interest rates in the US and trigger mini-collapse in the stock-market in December 2018 and a decline in US industrial production in early 2019.

The ability to create token money in massive amounts like in 2008 is also limited because that increase has not been fully unwound since then.

The US Federal Reserve which operates like the world’s central bank virtually doubled the token money supply overnight to prevent the broader collapse of the banking system.

In fact, the government often simply bought the worst form of debt mortgage-backed bonds called toxic assets off the banks for cash and government securities with newly created token currency. This is in effect turning some of the credit money into token money and increasing the possibility that the US currency will lose value in an inflationary surge and worst of all lead to a surge in interest rates followed by a new sharp contraction of credit.

Why is inflation low?

What is remarkable and need explaining is why there has not been an immediate inflationary surge followed by a surge in interest rates following that binge of money printing.

Mindful of the lessons of the 1970s, the Federal Reserve held off on intervening until the fourth quarter of 2008 when the crisis was already underway and panic had already broken out. This meant that there was a huge demand for US dollars as a means of payment in the world’s financial system. Most debts in the world are denominated in US dollars. Everyone wanted dollars to settle the debts that were being called in rather than rolled over.

Capitalists all over the world were also desperate to build up their cash reserves as much as possible to protect against future risk. The US dollar became a preferred means of hoarding.

The Fed made it clear it would create whatever amount was needed to stabilise the system. They even agreed to pay interest on the massive reserves now being held by commercial banks in their Federal Reserve Accounts.

There has not been a generalised inflation as a consequence because the money was absorbed and used as a means of payment during the crisis and after as a means of hoarding.

The “Fed” also committed to returning to monetary normalcy by reducing the increased money supply as quickly as possible.

The huge increase in the money supply also pushed down interest rates to historic lows. This should have given added impetus to the recovery that followed.

The rescue of the banks and broader credit systems in 2008 has meant that there hasn’t been a proper cleansing of the rot in the system.

US corporate debt has doubled in the US to $9 trillion since 2008. Government debt has doubled to $21 trillion. US consumer debt at $13 trillion also exceeds the 2008 level again.

But this business cycle for US capitalism has been one of the weakest in history. Industrial production after ten years remains at only 80% of capacity utilisation. This is the chief reason the cycle is longer than usual. The development of overproduction was limited and the outbreak of a new crisis was delayed.

Secular stagnation

The actual economic decline during the 2008-2009 recession was far more severe than any other recession since the great depression of the 1930s. Normally there is a strong relationship between the speed and strength of the recovery and the preceding depth of the recession. Not this time. In fact, the record weakness in the economic recovery has led to this stage of capitalism being dubbed a period of “secular stagnation.”

Partly because capitalists have hoarded dollars rather than invested them, the recovery was so slow that the Fed was forced to continue Quantitative Easing until October 2015 rather than return to monetary normalcy quickly.

The Fed then began to shrink the monetary base by a modest 5.6% annual rate for five years after a 20% annual growth for seven years. The Federal Reserve funds rate also crept up from zero to 2.5%.

Monetary growth policies to resume

The decision to cut the interest rate at its last meeting is a signal that monetary growth policies will resume. They also agreed to convert the mortgage-backed securities they hold as a consequence of various bailouts to government ones as is normal.

The cut in the Federal Funds Rate, the signs of a global slowdown, the promised monetary easing, and a flight to safety in US government bonds has again pushed long-term interest rates down. This is what Trump and the Fed wants.

Trump is pushing for even stronger easing steps to help ensure there is no deep recession before the next Presidential election in 2020. But if the Fed is looking like it is responding to Trump’s tweets rather than objective decision making it loses credibility, which is expressed in a rising U.S dollar price of gold. This can undermine the “confidence of the markets” ie big financial capitalists who invest in the bond and currency markets in whether the Fed is making the “correct” decisions or rather actions that will increase the chance a new surge in inflation, followed by the inevitable higher interest rates with all their consequences. Even if this does not happen, in order to preserve its credibility the Fed might have to follow a “tight” policy longer leading to a deeper recession than otherwise would occur. Trump’s own panic about his reelection chances, therefore, could make things far worse than they would otherwise have to be at this stage.

While there has not been a broader inflationary surge yet, there has been a steady increase in the “price” of gold in US dollars as first the 2008 financial crisis and then quantitative easing policies were launched. The price hit $1657 in 2012 before dropping again to around $1000 in 2015 as more confidence the worst was over returned and the Fed moved to slow down its post-crisis “quantitative easing” campaign.

A return to positive interest rates and an end to money printing after October 2015 should have led to a further fall in the dollar price over the last few years. Instead, the price of gold remained stable and at the first hint of a return to a positive rate of growth in Federal Reserve System dollars is back over $1500 an ounce.

The traders in gold, the speculators proper, clearly don’t have renewed confidence that the original reversal of easing was serious enough, or that the renewed easing is justified. They suspect the easing is too soon, that the easing is happening before the credit squeeze and recession created enough increased demand for dollars as a means of payment that allowed the easing to occur in 2008 without broader inflation.

The promise of zero or negative interest rates by other central banks is also encouraging hoarding in gold. You may not earn interest but your wealth is at least preserved.

A new surge in the price of gold in US dollars would force the Federal Reserve to reverse course and start hiking interest rates and reversing easing once more.

Facing an election-year recession, Trump might then in desperation, attempt to fire the head of the Federal Reserve Jerome Powell and force the Fed to continue to expand the quantity Federal-Reserve created dollars until the election in November 2020. He has already hinted at doing this in late 2018, and more recently labeled him “clueless” and an “enemy” of growth. A move like that would provoke both a political and economic crisis that fed on one another of gigantic proportions.

Watch this space over the next few months.

(For those wanting a deeper look into the issues raised here I recommend the following blog A Critique of Crisis Theory from a Marxist Perspective – M.T)